Investment Banking

A Market-Based Approach

to Investment Banking

FINNEA Group’s Investment Banking services include complete sell-side advisory services, capital solutions, and buy-side advisory services for privately held and publicly traded companies. FINNEA’s Mergers & Acquisitions team has an extensive track record of successfully managing, negotiating, structuring and closing transactions to help optimize our client’s objectives in many industries.

Our team uses a unique market-tested approach that enhances deal terms and economics while minimizing disruptions. Our disciplined process is focused on analytics, market insight, experience and credibility. Having worked at leading global investment banking firms, our deal teams bring “bulge bracket” experience to our middle market clients, completing hundreds of domestic and international transactions. We have honed the “FINNEA Approach” to help deliver optimal outcomes by constantly assessing and adapting strategies based on each client’s unique needs and challenges. We believe in adding value with market data, experience and a straightforward communication approach. We strive to build long-term relationships with each client based on honest advice supported by market analysis.

We advise private companies, divisions or business units of larger public companies and private equity firms to identify a full range of divestiture acquisition options and financing solutions.

Sell-Side Advisory

As a leading sell-side group, we advise, develop and execute optimal strategies for the sale or recapitalization of businesses, including:

- Complete management of the sale process, including leading complex negotiations, minimizing disruption and allowing business owners to focus on operations

- Pre-launch and transaction preparation, including detailed financial models and marketing materials

- Sourcing buyers – develop a list of potential buyers/investors and manage the outreach process by creating a competitive dynamic experience throughout the transaction

- Establishing seller’s credibility – FINNEA’s reputation with both strategic buyers and private equity groups is well established, thus allowing for productive and trusted conversations

- Thorough collaboration amongst advisors to meet or exceed the client’s objectives and create a clear path to close

Capital

Solutions

FINNEA Group’s Investment Banking team has extensive experience in raising both third-party debt and varying forms of junior capital.

FINNEA’s Capital Solutions services include:

- Growth & acquisition financing, and/or recap financing to fund shareholder liquidity

- Structuring and securing third-party capital, including mezzanine, second lien and other forms of subordinated debt as well as asset-based loans and senior secured bank debt

- Raising equity capital for clients, including common stock, preferred equity and varying forms of convertible equity

- Advising clients on equity and incentive structures, often associated with key management incentive plans

- Evaluating and implementing capital allocation strategies for companies such as dividend policies and working capital management

Buy-sideAdvisory

- Development of acquisition thesis and identification of targets that fit those parameters

- Complete management of the acquisition process, including negotiations – minimizing disruption and allowing business owners to focus on operations

- Develop transaction financing options and solutions

- Detailed financial models, including accretion/dilution analyses

- Post-merger integration strategy and analysis

Industry Experience

At FINNEA, we combine our deep expertise in multiple industries and sectors with our expansive knowledge of innovative and practical solutions. Our team is committed to helping businesses achieve their goals, providing vision, talent and expertise to execute successful transactions and create value. Since launching our investment banking services in Birmingham, MI, FINNEA has provided expertise to companies worldwide. From our beginnings to our recently opened office in Nashville, TN, we continue to expand our team to better serve businesses across diverse locations and industries.

Business Services

Industrials & Manufacturing

Environmental Services

Healthcare

Logistics & Warehousing

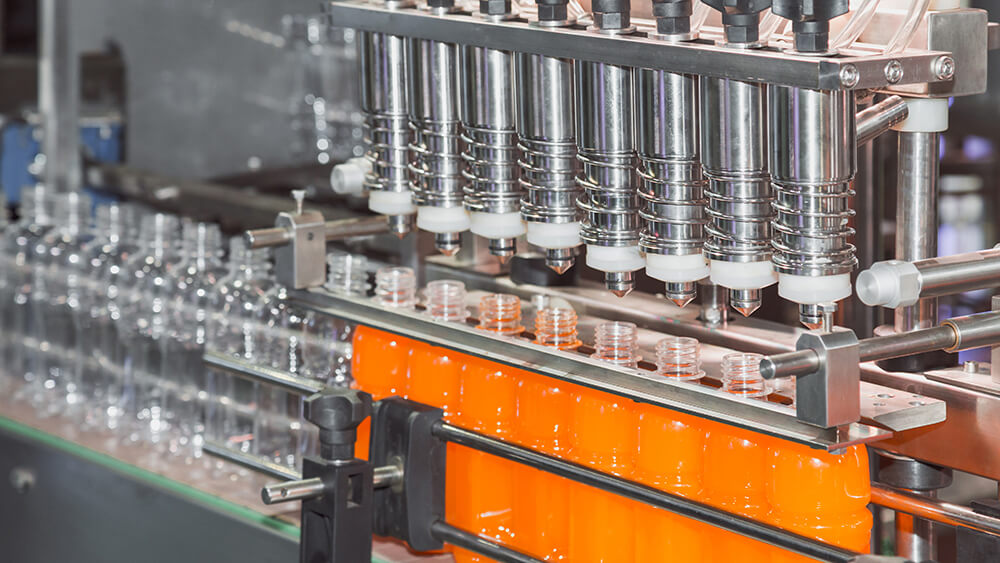

Packaging & Plastics

Consumer & Retail

Technology & IT Services

Aerospace & Defense

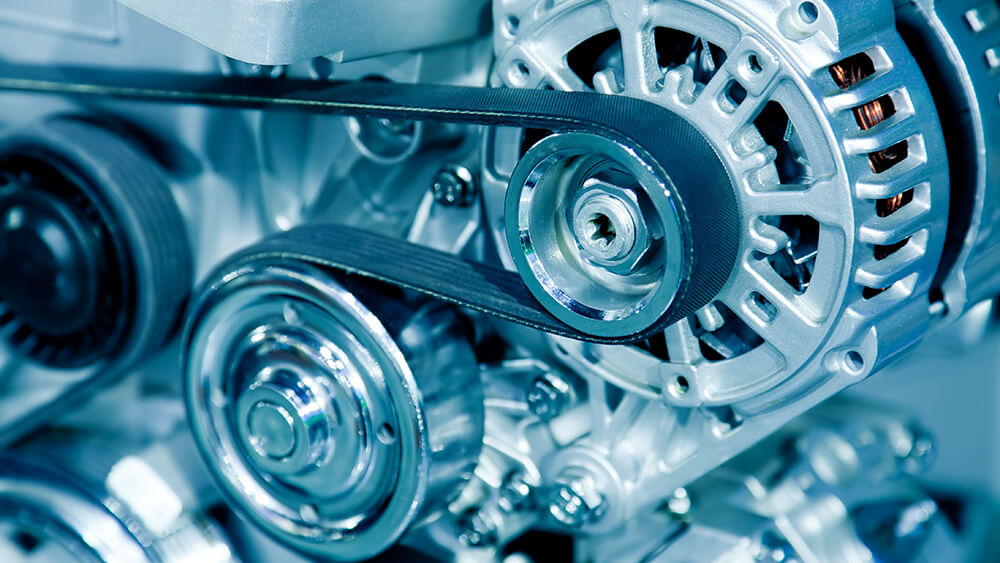

Automotive

Food & Beverage

Metals & Mining

Tech, Media & Telecom (TMT)